Skift Take

The rate of recovery for meetings and events has sped up fueled by smaller meetings and events of 200 attendees or less.

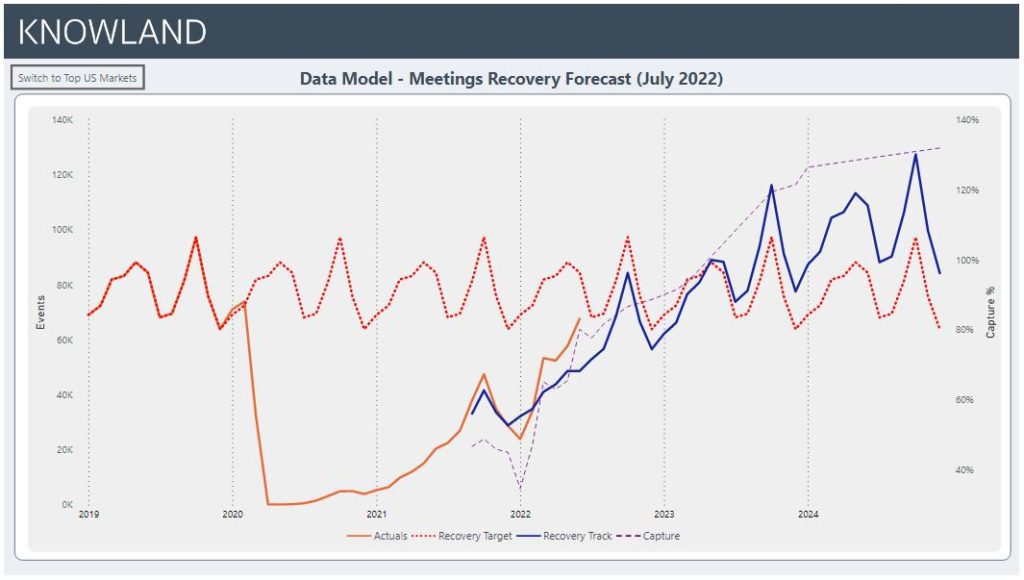

The meetings and events industry is on track to reach full market recovery next year, according to data and hospitality technology company Knowland. Its quarterly update to the U.S. Meetings Recovery Forecast (MRF) and associated Top 25 U.S. Meetings Recovery Forecast (MRF25) was released today.

Knowland now forecasts a 72.1 percent recovery by the end of 2022 for the U.S. meetings industry, an upgrade from the 58.3 percent forecasted in April.

This data suggests that a recovery is happening quicker than previously forecasted. “We are seeing the pace of recovery speed up fueled by smaller meetings and events of 200 attendees or less,” said Jeff Bzdawka, chief executive officer of Knowland.

The report shows growth in every month of the second quarter. This growth exceeded previous predictions, with some exceptions, but marks a shift in the overall forecast. The confirmation of growth is a welcome sign as the economic downturn dominates the headlines. “Even with ongoing concerns about the economy and Covid variants, the industry is rebounding in an unprecedented way,” said Kristi White, chief product officer, Knowland.

The long-term forecast beyond this year is even more positive. Meeting levels are expected to reach 106.3 percent of 2019 levels in 2023 and 115.7 percent in 2024.

Corporate events are driving the recovery, with several markets already recovering at more than 90 percent of 2019 levels in this segment. The volume of meetings and events in the U.S. was flat with the forecast in the first quarter, but increased by 25.8 percent in the second quarter.

June figures show a 334 percent growth in meeting volume compared to June of 2021 and an almost 17 percent increase from May. “We are seeing the build,” added Bzdawka.

Knowland’s holds a historical database of almost 20 million events and its forecasts provide an overview of how the U.S. as a whole and the Top 25 Markets, specifically, will move through recovery. Their website includes detailed charts for the top markets being tracked. Las Vegas is the one glaring omission from Knowland’s data set.

Eleven markets have improved their recovery forecast compared to the April report. There are Anaheim, Atlanta, Chicago, Denver, Detroit, Nashville, New Orleans, Hawaii (Oahu Island), Orlando, San Diego, and Seattle. On the flip side, the outlook is now less positive for Houston, Philadelphia, Phoenix, and Washington, DC.

Despite the downgrade Phoenix is still among the markets expected to be fully recovered by the end of the year. The other markets expected to recover the quickest are Dallas, Tampa, and Nashville. On the other end of the spectrum are Norfolk, Oahu Island, Philadelphia and Seattle which are not expected to reach the 50 percent recovery mark by the end of 2022.

In total 23 out 25 markets tracked are expected to achieve 100 percent or greater recovery by 2024, the two outliers being Philadelphia and Detroit.

This data is certainly good news for the industry with projections boosted by strong second quarter figures in almost all U.S. markets. With fears of a recession in 2023, uncertainty is still the dominating feeling.

Photo credit: Headshot of executive business leader attending conference, business meetings, and events outside of San Francisco in Wine Country (Healdsburg CA). Operators Guild / Unsplash